|

[VIEWED 33618

TIMES]

|

SAVE! for ease of future access.

|

|

The postings in this thread span 6 pages, go to PAGE 1.

This page is only showing last 20 replies

|

|

|

jhyalincha

Please log in to subscribe to jhyalincha's postings.

Posted on 12-26-06 4:41

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

I have been reading the other thread (bumper yield on wall street) and it makes for some good read, but it is also not really helping a lot of nepalese that have little or no experience/knowledge about the market. I am reading up on all these proclamations by the threaders (and maybe they are telling the truth), but I can easily see the ramifications -- ever seen those auto commercials where they say 'do not try this at home"? This is one of those things. Forget options, futures and currency swaps unless you know what you are doing. Heck, even stay away from individual securities if you can help it. for beginners, go after mutual funds. try cheap mutual fund houses such as Vanguard, Trowe and Fidelity. go to morningstar.com and look for the 4 and 5 stars; and then most important, create a well diversified mix--have proper controls in place so you dont have everything correlated to the market; go after index funds to minimize costs, and place your equity exposure in accordance to your age (for example, if you are 30 go after 30% in bonds and cash and the rest in stock exposure) by the same token within the stk exposure break it down 50/50 between domestic and international-- choose an index fund copied around the wilshire 5000, and an international index fund chasing the msci (international index)---with fixed income (bonds) have 1/3rds in mmkt, an bond index fund, and a high yield. there, that should do it. Dont forget to rebalance it every year though.

|

| |

|

|

The postings in this thread span 6 pages, go to PAGE 1.

This page is only showing last 20 replies

|

|

|

timetraveller

Please log in to subscribe to timetraveller's postings.

Posted on 12-29-06 12:48

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Hukka, which brokerage firms are international firms avalable through? What about the commissions? Do they charge more for international stocks? I checked a few and couldn't find a way to invest in them. Canadian firms don;t seem to have a good website. I'm more interested in trading although I shouldn't neglect long run opportunities. And the reason I said gold was for the long run, decades...i think once china's currency truly competes against other currencies, Chinese assets will be wayy more expensive to purchase. A portfolio with a lot of Chinese assets can be hedged by balancing it with precious metals and stocks of companies involved in mining and exploration of precious metals. Actually that'd be one arrow two bhangera (ek teer, do shekaar). Haina?

|

| |

|

|

hukka_nepali

Please log in to subscribe to hukka_nepali's postings.

Posted on 12-29-06 12:54

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Hi haami, I've already talked about my chinese stocks earlier in the discussion but don't mind going over it briefly again: I own CTRP -- which is kinda like your priceline.com or travolocity.com here for hotel and airline booking. online travel booking is still at it's very early stages in china, and if you know the history of it in america you can't help to be more excited about the possibility of CTRP in chaina for the future. plus chinese now have money and they are travelling (oh yeah they do bookings by phones and through local agents too, so they get their traditional customer that way and online for the new tech wiz). Currently stock price is $60+ and has gone up over 25% in the last 1 month so wouldn't recommend buying right away but not sure if there will be a pull back. I own LFC -- china life insurance. with billions of people how can you go wrong with life insurance (still the concept of buying life insurance is fairly new in china but as more people start to accumulate wealth, so will increase their worries for health / death). this has been my best stock pick of all time with over 200% in return so at it's current price i can't recommend a buy but anything with china health care / insurance / or even finincial / banking sector should be a good long term investment. I own ACH -- largest aluminum producer in china and still trading at a bargain price. fastest growing ecomony like chaina will need a lot of alumunim along with other metals so any type of chinese metal company (that is not over priced) should be a great buy. MPEL -- recently IPO, I don't own it yet but seriously considering (and most probably will buy it). this is a casion stock based in Macau which is autonomous part of china. my philosophy is plain and simple here; chinese people in general love to gamble and there are lots of chinese with lots of money now and casion stocks in general have great margins as they are not really selling any product. so anything in the chinese gaming / casion stocks are good but i like this one because of it's value. last but not the least, can't ignore chinese energy sector but i'm yet to explore those. may be some of you can or have already.

|

| |

|

|

timetraveller

Please log in to subscribe to timetraveller's postings.

Posted on 12-29-06 12:59

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Hi_nanu...most brokerage firms allow trading of commodities. There are many ways to invest: 1. Through companies that are involved in mining of gold 2. Through ETFs as well (Exchange Traded Funds). Think of ETF's like mutual funds, but they can be traded like stocks! What does that provide you? ETF's are less volatile but are good way to invest because they are chosen in a way that represent a mix of companies in the same industries and represnt an average valuation of all those firms. If gold prices go up, so should the value of these companies. 3. Through futures- now this is more advanced stuff- something not even I am comfortable treading into. Beware though, Gold prices are notoriously high right now. Look around for some more advanced analysis in the news, finance websites. Gold's value again'st the USD is also insanely high. So wait for a correction to come- let the price fall. The US china battle of economic wits wont occur for the next 10-12 years, you have significant learning time frame till then. -TT

|

| |

|

|

hukka_nepali

Please log in to subscribe to hukka_nepali's postings.

Posted on 12-29-06 1:06

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Opss typo: kept typing casion instead of casino. timetraveller, i'm sure every brokerage firms let you buy international stocks. their price may vary along with tax laws but i wouldn't worry about them. i use scottrade and they charge $7 for every transaction, regardless of US or foreign stocks. And i don't think anyone can argue about investment in gold because it doesn't get any safer. but at the same time, your ROI on is fairly limited as well. so, i say depending on where you are at with your life age / finance wise, you need decide how much you want to put in gold. it's all based on your risk threshold.

|

| |

|

|

timetraveller

Please log in to subscribe to timetraveller's postings.

Posted on 12-29-06 1:08

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

100% agree about MPEL Macau as I've read (could be total gossip and rumour) is also China's gang lord's playground. Nepalis work there in those casinos. It would have sucked to have been in on the IPO but oh well I think I'll buy it as well. Lovin the comversations. I'm wasting my Friday.... School starting soon. NOOOOOOOOOOOOOOOOOOO :(

|

| |

|

|

Hi_nanu

Please log in to subscribe to Hi_nanu's postings.

Posted on 12-29-06 1:09

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Thanks Timetraveller and all who are sharing theri experinces in this forum...Lots of people getting opportunities to add so many points in their learning curve... Thank you all... I am reading every posting of this thread....it is hard to understand all those but still trying to learn Happy New year

|

| |

|

|

haami

Please log in to subscribe to haami's postings.

Posted on 12-29-06 1:16

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

hukka_nepali, Have you done any research on ISP (Internet Service Provider) companies in China? With the online users number increasing there, these companies should do well as well. Thank a bunch, haami

|

| |

|

|

KnightCrawler

Please log in to subscribe to KnightCrawler's postings.

Posted on 12-29-06 1:24

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Highfly and Hukka_Nepali: Appreciate the knowledge....and all others in the field....Its always good to get the answers in a snapshot, rather than on a literature issued by these investment companies, which are confusing to say the least.... Looking forward to more knowledge sharing.......

|

| |

|

|

timetraveller

Please log in to subscribe to timetraveller's postings.

Posted on 12-29-06 1:31

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

www.investopedia.com Check it out. Thousands of articles. Read all day, all night long. Write, take notes, do everything you can. But just do it :D

|

| |

|

|

hukka_nepali

Please log in to subscribe to hukka_nepali's postings.

Posted on 12-29-06 1:32

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

haami, i don't know about ISP but perhaps we can look into the telcom sector in china. but i doubted we'll find any good ones at a great value consider the secret already being out (2 billion people and their 2 billions + communication). the thing is, when you think about investing you need to "think outside the box", you can't be seeing the same thing everyone sees because the share price is already gonna reflect their hopes and potentials and will have very little for yours.

|

| |

|

|

highfly

Please log in to subscribe to highfly's postings.

Posted on 12-29-06 2:06

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Anybody intrested in some groups like google or yahoo. We can do research on ceratin funds, stocks or other investment and post result in group. This way we will have more sorted out info to be used for investment. Just a thought. peace out

|

| |

|

|

haami

Please log in to subscribe to haami's postings.

Posted on 12-29-06 2:19

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

in fact I was thinking of the same highfly. Anybody willing to volunteer in creating a yahoo group? thanks, haami

|

| |

|

|

timetraveller

Please log in to subscribe to timetraveller's postings.

Posted on 12-29-06 2:42

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Lets contact San and ask him to create something right here.

|

| |

|

|

timetraveller

Please log in to subscribe to timetraveller's postings.

Posted on 12-29-06 10:42

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

just a bit of deviation: SADDAM'S DEAD!!!! YAY!!!

|

| |

|

|

timetraveller

Please log in to subscribe to timetraveller's postings.

Posted on 12-30-06 7:09

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

just keepin this thread alive...

|

| |

|

|

Hi_nanu

Please log in to subscribe to Hi_nanu's postings.

Posted on 12-30-06 7:19

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

What kinds of effect saddam's execution will bring into stock market?Any thoughts...

|

| |

|

|

kalebhut

Please log in to subscribe to kalebhut's postings.

Posted on 12-30-06 10:09

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

Stock exchanges in China are still at its initial stage of development.The best way to invest in China is to look for Chinese stocks listed in HK stock exchange ..also collectively known as H shares. Hong Kong’s benchmark index (HSI) has hit a record high at 20000 few days ago. Besides, Hong Kong exchange has been a productive place in raising capital or IPOs of Chinese companies in recent times. Thanks to the British colonial rule, HK has achieved the status as world’s financial centre in just 20 years to what it took 300 years for London to reach the same stage. As a rookie.. myself, I have no exact recommendations on Chinese stocks. I would suggest you to diversify at least 10% of your portfolio in china related investments, so that in case of the crisis it will have little effect on your portfolio. China’s volatile economy and HK’s service based economy could be a serious threat for small investors and traders alike. You may also want to check all the investment opportunities with your brokerage companies, before you put your money in China. To nanu’s question.. Saddam’s execution will have no effect in stock markets around the world other than few protests of human rights violation in places like Nepal and of course in the media etc. But violent retaliations by the sunnis muslims could lead to more chaos in Iraq as well as fluctuations on crude oil prices. Rise in crude oil prices could slightly affect the stock markets but you should be safe in your investment goals

|

| |

|

|

eminitrader

Please log in to subscribe to eminitrader's postings.

Posted on 12-30-06 11:16

PM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

One of the strategies used by many mutual fund managers is to buy the top performing sectors in the 1st two weeks of the year. Most of the mutual fund managers are chasing performance so they will buy what is hot at that point. I will post what sector is hot after 2 weeks. I would not be surprised if we see some type of correction here. S&P is currently at 1420 and 1320 was the previous resistance. The markets have a tendancy to test the previous resistance before going to a new high.

|

| |

|

|

timetraveller

Please log in to subscribe to timetraveller's postings.

Posted on 12-31-06 1:04

AM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

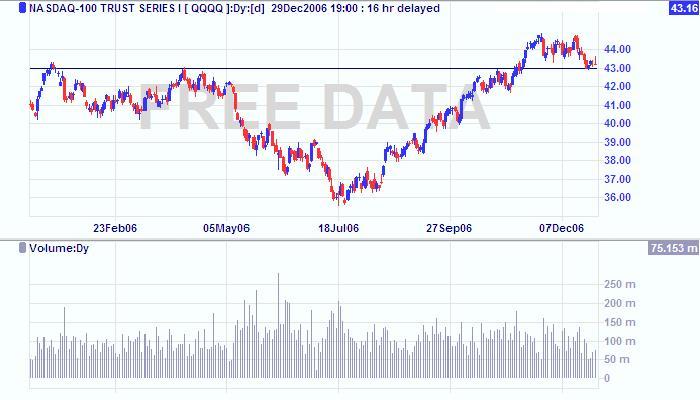

I agree with eminitrader. Look at the chart of the QQQQ fellers. If this baby breaks through that long black resistance across the chart and goes downwards, I believe it is an early sign that overall markets will see a correction. For those who don't know what the QQQQ is, in layman's words, it just tracks the 100 top stocks in NASDAQ and are highly correlated with NASDAQ. It's an ETF- Exchange Traded Fund. In my previous post I explaiened to someone that an ETF is like a mutual fund, except it can be traded like stocks. Tracking this can show early promising signs of overall market conditions

|

| |

|

|

latoboy

Please log in to subscribe to latoboy's postings.

Posted on 01-07-07 10:52

AM

Reply

[Subscribe]

|

Login in to Rate this Post:

0  ?

?

|

| |

anyone here have the motley fool 2007 stocks guide ??

|

| |